Corporate Bandwagon

A big-box trend challenging dentistry’s private practice structure

By Arlene Furlong

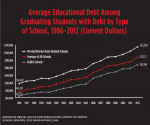

Group practices—both traditional multi-specialty and larger corporate configurations—are drawing in record shares of dentists who say they find personal and fiscal advantages in these multi-practice arrangements. There are many well-established reasons why group structures attract dentists. In a group setting, the traditional burdens of running a solo practice, such as maximizing patient care hours, negotiating discounts with vendors, and mastering practice management skills, can be shared with others, rather than shouldered independently. Today, there are additional influences expanding the appeal of the multi-practice business model for a larger segment of US dentists. For example, most dental students graduate dental school with sizable debt. As such, they have a pressing need to acquire a steady income immediately following graduation, rather than take on the financial burden of another loan to purchase a practice or establish a new stand-alone dental office.

On the other end of the spectrum, the number of aging practitioners who find a lighter work schedule attractive and are lured by the possibility of selling their practices keeps growing. With dental graduate debt unwavering and the number of dentists reaching retirement age climbing, outside investors interested in expanding large groups find an ideal buying environment: an increasing supply of available dental professionals and a growing supply of dental practices for sale.

No one form of dental practice will completely overwhelm the current marketplace. However, the spread of large dental groups is also driving a structural shift in the laboratory industry. As the percentage of solo dental practitioners declines, so does the rationality for making the single practitioner the sole business strategy focus. Bigger companies produce higher productivity rates and financial growth. Dental laboratory owners who keep this in mind will have the better chance of successfully adapting their business plans to meet dentistry’s changing demands.

Ever-Increasing Evidence

The research leaves no doubt—the number of dentists going into group practices is steadily increasing and the very largest group practices are getting even bigger. The ADA Health Policy Resources Center (HPRC) reported that some 69% of dentists were solo practitioners in 2010, down from 76% in 2006. Simultaneously, very large group dental practices were up 25% between 2009 and 2011, from 2,000 to 2,500. In 2008, very large group practices—those with more than 20 dentists—accounted for 3% of all US practices. By 2012, dental consultants were estimating that a full 8% of all US dentists (about 12,000 individuals) were employed by very large dental companies. Furthermore, preliminary findings from HPRC’s Group Practice Database (to be released Q1 of 2014) show that 9,000 dentists were employed in the 100 largest groups in 2013.

Oft reported as earning higher profit margins than medical group practices, many large dental groups are attracting the infusion of capital investment and are backed by private equity firms. “The economics of our country are dictating dentistry’s direction and everyone is adjusting to a new model,” says Edward Meckler, DMD, chair of DentalOne Partners, one of at least 25 dental service organizations (DSOs) backed by a private equity firm. DSOs grow by purchasing practices and adding them to their dental practice business and administrative support system.

DentalOne Partners is comprised of more than 160 affiliated practices in 14 states. “Solo practices won’t go away; they just won’t be as common,” predicts Meckler. Like most DSOs, (Meckler prefers Dental Support Organizations to Dental Service Organizations), DentalOne Partners provides a full range of practice management support services to its dentists, including administrative, marketing, recruiting, insurance processing, and legal services. About 375 dentists are affiliated on a full or part-time basis and the company employs about 2,000 people overall. Meckler says gross revenues continued up in 2012 from 2011. Also the executive director of the Dental Group Practice Association (DGPA), Meckler says the organization is comprised of 31 very large groups, each with annual gross revenues of more than $30 million. He says membership has experienced double-digit growth in the last few years, “in terms of both doctors’ revenue and number of doctors.”

As conflicting reports surface about how the newer, very large corporate dental companies may change the profession, traditional multi-specialty group practices in one geographic location are also gaining more dentists’ attention. “Based upon our observations and surveys, the typical academy model—between two and eight offices—appears to be the economic sweet-spot for dentists,” says Robert Hankin, PhD. Hankin is the President and Chief Executive Officer of the Health Industry Business Communications Council, where he and his staff have provided executive and administrative oversight to the AADGP for more than 25 years. “Dentists in groups of this size say they are more satisfied with their work and can manage their schedules better than when practicing alone, says Hankin.

According to the 2012-2013 AADGP Group Practice Benchmarking Survey, private group practices with two doctors make up 29% of its dental practice membership and private group practices with three or more doctors make up 56%. Government-based dental programs comprise 4% and dental practice management companies make up 11%.

In addition to practice management support, many groups offer dentists other benefits, such as continuing education. And if the group is owned by a corporation, dentists are likely paid a salary and off the hook for building and equipment expenses. Although titles defining various group dentistry models aren’t yet standardized, groups sometimes vary their structure depending on state laws regulating who can own and operate a practice in a specific location. The ADA is in the process of developing a classification system for all types of group practices.

Efficiencies of Large Groups

Economies of scale enable groups to negotiate better contracts with vendors, such as dental laboratories and manufacturers, than solo practitioners can. It is a way for dentists to become price makers vs. price-takers. However the financial success of very large groups, particularly corporate-owned groups, is often attributed to their middle-of-the-road pricing strategy. Corporate group dentistry leaders say larger groups can take insurance plans providing lower reimbursement rates than solo dentists can, thereby attracting more patients and also providing more treatment to people who may not otherwise pursue it.

“The quality of care provided to patients isn’t lesser,” says Meckler. “It’s just that the efficiencies are greater.” Skeptics say any possible patient savings can’t be long-term because finding new ways to maintain a growth rate that satisfies shareholders amid an increasingly competitive field will eventually be exhausted. They believe economies of scale created by joining dental practices are limited because practice management support, equipment and supplies are a smaller percentage of overall cost than frontline provider care to patients. Albert H. Guay, DMD, and ADA Chief Policy Advisor Emeritus, says it is difficult to predict the future of any aspect of the dental marketplace, particularly during this time of turbulence. “Those who provide the best care, most efficiently, for the most people and are innovative will prosper,” says Guay.

In the US, the connection between size and productivity is particularly close. Bigger companies are also better able to make investments in productivity-enhancing technology. For example, almost all of the some 350 dental practices affiliated with Pacific Dental Services, Irvine, CA have onsite milling units, according to Mr. Stephen Thorne, founder, president and CEO. However, when Pacific Dental Services-supported dentists need laboratory services, they work with outside laboratories that provide digital imaging options. Mr. Thorne says the dentists choose the laboratories they want to use and Pacific Dental Services helps to negotiate pricing.

Dental laboratories accustomed to working with large groups know how to increase volume without increasing costs.

“A laboratory has to be extremely price oriented to work in this environment, says Bob Starr, Chief Administrative Officer of MicroDental, Dublin, CA. “Because corporate dental practices often need cost-efficient pricing, laboratories need to find ways to offer lower-priced products.” Formerly known as Dental Technologies Inc., MicroDental added large corporate dental groups to its customer base during the last few years, and has been working with smaller traditional dental groups for almost a decade. Corporate dental groups and smaller traditional groups each make up less than 5% of the total production generated by MicroDental’s network of 17 laboratory operations in the US and three in Canada. Starr credits digital technology for the laboratory’s ability to produce more without increasing costs, without sacrificing quality or consistency, or going offshore.

Some laboratories have anticipated this movement in the industry, and have started to adjust their production processes to better accommodate a large group model. An example of such a laboratory is Sun Dental Labs in Clearwater, FL, which made a very significant investment in digital technology to prepare for working with very large corporate groups. The laboratory acquired 3D printers, digital scanners, milling equipment, and new technicians skilled in CAD design and restoration modeling. “Improved quality, better documentation and more consistency is what it’s all about,” says Chuck Tagliarino, CDT, Vice President of Operations. In the profession for some 35 years, Tagliarino says the days of operating with less than efficient systems that were still somehow adequate to make a profit are gone. “We’re adopting changes that decades ago would’ve been deemed space age,” says Tagliarino. “Corporate partners demand consistent quality at a reasonable price. It is now easily achievable. What you do want, however, is to work with a dental group that values a long term partnership where both parties can benefit.”

Challenges for Laboratories

Many dental laboratory owners and operators are not overly enthusiastic about developing new strategies to generate product lines that can meet lower price points, yet did so anyway. Knight Dental Group in Oldsmar, FL did not use offshore production until it became necessary to create a lower-priced line for its DSO-owned practices, some of which had been buying Knight’s highest tier restorations prior to being DSO-purchased. Although satisfied with current business ratios, Warren Rogers, Chief Executive Officer, has chosen to target the smaller and more multi-specialty group practices with Knight’s technology-driven products. He figures that between the traditional multi-specialty group practice clients Knight has had for many years and newer practices under a DSO umbrella, traditional and large groups make up about 10% of his total business. He advises that no single dental group should comprise more than 3% to 5% of any laboratory’s total business. Rogers explains, “There is already evidence of some large labs who have lost favor and considerable revenue from large groups and who have experienced detrimental financial losses.”

Being selective about choosing clients is one of Knight’s longstanding business tenets and their promotional process is to market to dentists that have been prequalified. The laboratory changed strategies on technology-produced products last year by advertising to the general market and gained new business. But the new business came at a price “Our remake rate went up dramatically,” Rogers said.

Jerry Ulaszek, CDT, owner of Artistic Dental Studio in Bolingbrook, IL, is reluctant to allow larger groups to control much of his business flow. The 75-person laboratory opened in 1981 with just four employees. “We worked with the traditional groups back when the average size was about six dentists. Larger groups were in a better position to dictate fees and we watched our profits diminish when we worked with them.” Ulaszek says his experience has shown that the mutual respect and rapport that develops when working with one or two doctors erodes when working with larger groups. “The arrangement you discussed with your dentist customer is often overridden by a supply chain manager you have no relationship with at all.”

Relationships Count

Bennett Napier, Executive Director of the National Association of Dental Laboratories, believes that many laboratory owners mistakenly think that working with groups is solely about “cranking it out” at the lowest possible price. “It’s not an accurate assumption,” says Napier, who fears that some laboratories may be unnecessarily pigeonholing themselves into working with only one type of dental practice.

George Halverson, who founded Excel Dental Studios in Minneapolis, MN, in 1970 and served as CEO through 2008, says working with a large dental group can be a win-win for both the laboratory and the dental group. For many years, Park Dental in Roseville, MN, comprised 45% of the laboratory’s total business. “I was never worried,” says Halverson. “The relationship worked because it was based on disclosure and transparency.”

With some 26 Minnesota locations, Park Dental employs about 95 general dentists, 60 of whom own equal shares in the group. Doctor-owned and managed, the group is not affiliated with a dental service organization, but employs its own administrative services. “It’s a great model and we’re trying to expand,” says John Gulon, DDS who has been president since 2005. The group grows by merging practices, purchasing practices from retiring dentists, opening new locations, and bringing in new dentists. “Our patients are buying high grade restorations generated domestically,” said Gulon. “We like that we can offer US-made products. We’re able to provide restorations that exceed projected lifespans and our national remakes are half the national average of 5% to 6%.”

Excel Dental Studios became Twin Cities Laboratories in 2012, and has worked with Park Dental since 1986. The laboratory employs about 110 people and is now under the National Dentex banner. National Dentex was acquired in 2010 by GeoDigm, a portfolio company of the private equity firm Welsh, Carson, Anderson and Stowe. Twin Cities Laboratories provided some 11,000 restorations for Park Dental patients in 2012. According to Joel Richardson, who spent his entire career at Excel and is the current president of Twin Cities Laboratories, the laboratory and dental group have maintained a transparent relationship, and implemented projects and programs they all developed together. He explains, “If anything, results are better since the NDX consolidation because we have greater resources and access to more materials and technology.” Richardson says 40% to 45% of Twin Cities’ total business is with large groups. The remainder is with solo, two-or-three-person offices. 10% to 15% of their all-ceramic work is CAD/CAM-produced and the rest is printed in wax and pressed.

“I believe that our longstanding relationship provides a strong example of how a dental group and dental laboratory can grow together,” says Gulon. “Everyone needs to be able to control costs and create profit margins, but not at the cost of one entity over the other.”

Finding a Proper Fit

Stan Wilcox, CDT, Senior Technician in the removable department at Lighthouse Dental Studio in Racine, WI, says working with the right dental group—even being owned by that dental group—can optimize efficiencies and quality of work life for both. Opening just a few years after Racine Dental Group did in 1969, Lighthouse facilitates the dentists’ success and is valued accordingly, says Wilcox, adding that being in the same building gives the laboratory a unique advantage. “Whether you’re a large or small lab, dentists look to you for answers and close proximity makes it a lot easier to provide it to them.”

With 17 dentists (12 general practitioners) and two locations, Racine Dental Group’s dentists purchase equal shares in the practice and share many administrative services. The dentists like the model and are not considering selling to a larger group, according to Scott Munro, who has been with Racine for 17 years, and serves on its executive committee. “Having 12 owners can mean having 12 opinions, but it’s not a top-down situation,” Munro said. “Some of the corporate dental groups have high turnover rates. We expect our associates to be here for 25 years. They have autonomy and a true ownership mentality. I think the laboratory technicians have that same sense of stability.”

Munro advises dental laboratories against aligning themselves with doctor groups, or in fact, any dentist looking primarily for the best deal. He says, “You could end up changing your business plan and committing more or new resources, while the dental group is free to jump ship. Find out how much profit different dental groups can add to your business. But make sure you have a good relationship, because in the end, that’s what will maintain your bottom line.”

Transitions

Dentist goes from solo to group practice

Michael Kaske, DDS, who practices part-time for Midwest Dental, Twin Lakes, WI, and also serves as dental director, says his situation explains some of the growth of large group dental practices. In 2010, at 58-years-old, he was considering how to transition out of his practice.

“Midwest gave me the opportunity to sell my practice when it was at peak value,” said Kaske. “However, if I had to do it all over again, I may have done it a little sooner.”

Except for a single office, all of Midwest Dental’s practices were acquired from dentists interested in transitioning out of practice. Offering full-time employment with benefits and guaranteed salaries, Midwest Dental’s support center provides administrative and staff resources to more than 125 practices in ten states. “Another major driver of large group practice is the prohibitive cost of dental education and young dentists’ need for a guaranteed income,” Kaske said. “It’s difficult for a dentist to guarantee that income to an associate. Younger dentists bring a lot of growth to our group and the older dentists serve as great mentors.”

About 50% of dental offices that express an interest in selling to Midwest will get an offer, according to Kaske. “We have community-based goals. We want to keep the same dental team and the same patients in the practice. What we add is our administrative and management culture.” According to Kaske, company culture dictates that the doctors are always in control of patient care decisions, including selecting the dental laboratories they choose to work with. Some dental laboratories progress to “preferred” status. In addition to providing continuing education to doctors, preferred laboratories work closely with dentists on troubleshooting and material choices.

Purchased by Friedman, Fleischer & Lowe LLC in 2011, Midwest Dental obtained its third private equity owner in four years. Doctors are unencumbered by these changes, according to Kaske, “We have at the highest level of the organization dentists who will intervene to be sure we stay patient and doctor-focused and to be sure that people who are not dentists do not influence the clinical practice of dentistry.”