Staying Up In a down Market

As recessionary spending behaviors harden, dental professionals find success in value-driven strategies.

By Pam Johnson

The recent economy has decidedly altered the consumer landscape, and businesses are still learning to navigate this tougher terrain. Because of lingering concerns about the future’s stability, consumers are continuing to realign how they spend discretionary income. With its future growth tied to consumer spending, this reallocation of expenditures may significantly impact the business of dentistry.

“The mindset of the consumer has been and will continue to be affected by this economy,” says Roger Levin, DDS, founder of the Levin Group Inc., an international consulting firm specializing in dental practice management. “There is no question consumer spending behavior has changed.”

Patients are not only re-evaluating the justification and value of want-based treatment but also postponing routine services and delaying needed services. Even those in the higher income brackets who can afford elective services are holding off on treatment because they too are still feeling uncomfortable about making large expenditures. The result, says Levin, has been an across-the-board 17.8% drop in business for general dentistry between 2006 and 2010. The cosmetic segment of the dental industry is faring far worse, with cosmetic practice revenues off by 25% or more.

Timing for a full recovery remains uncertain, and some believe that this economic downturn may have changed consumer spending habits and mindset for the long term. A more frugal customer has emerged—one who is willing to make tradeoffs in price, brand, and buying convenience and is emphasizing saving over spending.

It is possible that this fundamental shift may not change even as the economy shows signs of recovery, which means that businesses dependent on consumer spending will be pressured to adapt to a value-driven market environment.

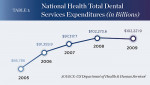

Dentists and laboratory owners will now have to create business strategies that move from a needs-based model to a wants-based model. “We as an industry have merely been accepting the whim and the mercy of the economy,” says Mark Murphy, DDS, FAGD, Vice President of Clinical Education for Microdental-DTI Technologies Inc. “We aren’t creating a strategic plan to capture patients’ discretionary income. Patients spend more every year on alcohol, gambling, cosmetic surgery, and pet care than they do on dentistry, and yet consumer spending on dentistry, with the exception of 2010, has increased every year” (Table 1).1

Consumers are also saving their money at an unprecedented rate. Caught by the sudden economic downturn without a financial cushion, Americans have emerged from the recession wiser and thriftier. From what he has been studying, personal savings rates have increased from less than -4.2% four years ago to more than 4.7% today, Levin shares. That’s an 8.9% swing representing discretionary income that is not being spent in retail or in dentistry.

For businesses, this fundamental shift in consumer behavior requires adapting to the new realities. Dentists and laboratory owners, who continue to rely on pre-recession strategies and are simply waiting out the recession for consumer spending to return, are taking a significant risk with the future for their businesses. “What worked four years ago does not work any longer,” says Levin. “Things change and you have to change with them.”

Challenges and Solutions from Chairside

What is happening in the general practice demonstrates how the shift in consumer behavior has impacted the profession. General dentists continue to report a decrease in net income as their new patient rate, gross billings, and patient treatment acceptance rates falter. The American Dental Association (ADA) Quarterly Survey of Economic Confidence indicates that from the third quarter of 2008 through the fourth quarter of 2010, more than half of the dentists in the United States reported a decline in their practice’s net income (Table 2).2 And although survey results from the first quarter of 2011 are cause for cautious optimism, the first quarter of each of the previous recessionary years has experienced a decrease in the percentage of clinicians reporting income declines and an uptick in business.

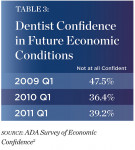

However, the uptick in practice income did not shake off skepticism that 2011 would be any more profitable than 2009 or 2010. When asked to express their confidence level in future economic conditions, the percentage of dentists who lost or were about to lose confidence in an economic turnaround actually rose nearly three percentage points this year, from 36.4% in the fourth quarter of 2010 to 39.2% in the first quarter of 2011 (Table 3).3-5

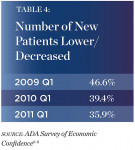

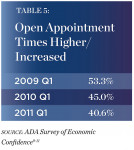

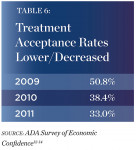

What has dentists concerned is the decline in the number of new patients walking through their doors (Table 4),6-8 open appointment time as more patients delay or postpone treatment (Table 5),9-11 and the reluctance of patients to accept a treatment plan once proposed (Table 6).12-14 “Patients today are very discriminating with their money and they are scared to spend it,” says James Cassidy, DDS, who maintains a private practice in Macon, Georgia. The economy, he says, has given patients one more reason to defer treatment.

So what can practices do to turn around the decline in new patient numbers? Levin counsels his clients to institute a strong internal marketing program to help increase practice traffic. “We are seeing practices effectively motivating patients to refer new patients,” he says. “We tell our clients that we want 40% to 60% of existing patients to refer at least one new patient to the practice.” To incentivize cosmetic treatment, clinicians can, for example, offer to new patients referred by an existing cosmetic patient a free preliminary consultation to help remove that barrier of entry.

But incentivizing new and existing patients to cross the practice threshold is only a small portion of the changes practices need to make, Levin counsels. Case presentation has to concentrate less on educating a patient about the clinical aspects of treatment and more on emphasizing the value and benefits of treatment. This means talking with patients to find out what their goals and needs are and then matching the patients’ resources with the right treatment options to achieve the expected outcome. Providing a source for patient financing is also critical, especially when it comes to elective and cosmetic services. Ultimately, practices must have step-by-step business systems in place that maximize customer service and increase production. “Today dentists need newer, more effective and efficient business systems that make it easy for patients to get in quickly, learn about their treatment options, make financial arrangements, and get treated quickly,” Levin says.

“The ability to change and adapt treatment strategies to the needs and challenges of the patient is essential,” Cassidy agrees, whose practice is strictly fee-for-service. “What I’m hearing from my patients is ‘Can you patch it up one more time and give me a year or two to get that crown I need?’” Small fixes, he says, fill chairtime when patients are reluctant to spend dollars on a larger treatment plan. They also guarantee the patient will spend the money on that crown when Cassidy counsels them that the tooth cannot withstand another quick fix.

Patients entering Cassidy’s practice are given what he calls a new patient exam that assesses the patient’s complete oral situation, from temporomandibular joint (TMJ) assessment to oral cancer screening, before any treatment begins. He then maps out a treatment plan and works with the patient to address each of the problem areas. “We are caring for our patients, not just treating them,” he says. “A patient with a broken tooth may have an underlying cause for that break. I will do a diagnostic re-evaluation to assess if that tooth was overloaded or if something else is going on and before you know it, I’m doing a quadrant of crowns, not just a single crown.”

To help patients afford simpler restorative treatment plans such as a couple of crowns, Cassidy allows patients to stagger payments to relieve some of the financial pressure. “They pay a third before treatment, a third at provisionalization, and a third when I seat the crowns,” he explains. Because many of his patients carry dental insurance, they receive the reimbursement payment between the provisional stage and final seating, which helps relieve the financial burden. For larger treatment plans, Cassidy offers several different patient-financing options ranging from Care Credit (a patient-financing institution endorsed by the ADA and Academy of General Dentistry (AGD) as well as 44 state associations) to arrangements with local credit unions and banks that will provide loans to practice-referred patients. As Cassidy admits, money is the single biggest obstacle standing in the way of treatment acceptance, and in today’s economic environment, it takes more time and effort to get patients to accept a large treatment plan. When he presents the plan to the patient, itemized with estimated costs, he includes in small print, +12%, which stands for lab fees/overtime. “When I go over the case with the patient, I pick up a red pen and tell the patient they have been such a loyal patient for such a long time, I’m going to forgive that charge,” he says. “I’ve sold more patients on large treatment plans with that 12% than I can tell you.”

If the patient still balks, his strategy is to keep them engaged in hygiene until he finds it absolutely necessary to begin the first phase of treatment or until they feel financially comfortable making the expenditure. “It’s like being an air traffic controller,” he says. “You have all these patients out there at different phases of treatment and you are directing them in for treatment one, two, three at a time.” He believes that it takes financial pressure off the patient, and they are less likely to shop around for another solution.

There is no doubt that the business of dentistry is different than it was four years ago, Levin affirms, and if clinicians continue to do what they did then, patients will turn down treatment, especially elective treatment. “On the other hand, if practices adopt new systems and employ new levels of efficiencies then they should do well despite this downturn,” he says.

But he also warns that there will be other challenges the dental industry will face in the future. “Times change and so do systems. The systems that work well now will not carry the practice through the next phase of challenging times.”

Adapting to a Value-Driven Economy

That same advice is equally applicable to the laboratory industry. With both patients and dentists shifting to a “pause and buy” value-based spending behavior, laboratory owners need to reassess product offerings and pricing as well as marketing strategies to realign their businesses to attract and grow customer segments. The inability of some laboratories to adapt to a changing market has had a significant negative effect. Laboratories that could not adapt quickly enough found themselves driven out of business, or at best, they have experienced a negative impact on business revenues while others who adapted to the new frugality in spending prospered. “The industry is shifting its approach to restorative dentistry and its mindset,” says Pinhas Adar, MDT, owner of Oral Design Studio in Atlanta, Georgia. “You can’t wait for current economic times to return to ‘normal’. This is the new normal.”

Buyer frugality is causing consumers, whether patient or client, to justify each dollar they spend and to expect a clear value advantage for that expenditure. Adar says that if the value of the purchase is not clearly communicated or visible, then that client has no qualms about looking elsewhere for that product or service. For laboratories, the simplistic business mentality of “you send the case, I build it, I send it back” is no longer viable in a value-driven market. That business mindset puts the laboratory in the vulnerable position of a vendor rather than a business partner.

“If clients only see your business as a provider or seller of products and services, then your business will go with the whims of the economy,” says Murphy. “But if your clients perceive you as an incredible resource, dedicated to helping them succeed by partnering with them and developing their skills at case acceptance, retaining patients, and converting patients to exposure of esthetic treatment, the laboratory will become a valuable resource the dentist can’t live without even in difficult economic times.”

Peter Pizzi, CDT, MDT, believes this is why the technologists who emerge from this recession and are successful in the future will be those who have built strong relationships with their clients and have the skills and knowledge to help educate and mentor them. “There is no such thing as a simple veneer case anymore or a simple molar case,” he says explains. “Why? Because the materials have changed, patient education has changed, and, more importantly, technology has changed.”

With so many different materials and technologies available for fabricating a case, Pizzi believes it is essential that technologists are able to didactically approach a case by looking at the cast and the clinical images and present a biomechanical, functional, and esthetic solution that best fits the client’s and patient’s needs and demands.

This level of service requires a higher degree of technical knowledge but also means keeping an eye on the economy and studying new marketing advances to keep pace with to keep pace with consumer behavior. Most importantly, it means developing better communication skills that can effectively bring the message to both patient and client. “Everyone assumes that means talking with your clients,” Adar says. “But it doesn’t. Communication involves listening to your customers and figuring out the demands of both the patient and the client and then having the ability to technically deliver those messages.”

Levin agrees. If laboratories could raise the amount of communication and education they provide to the practice, he says, they will be seen as more of a partner rather than an outside vendor. It is this transformation from suppliers of products to business partners that will bring value to the relationship and create a sustainable dental laboratory industry for the future. “What we need to do is to start working more on a relationship basis rather than financial basis,” says Levin. “And you have to add value to the relationship today.” What has him concerned is that if laboratories cannot communicate that value proposition to their clients and do not build that partner relationship, then the industry may continue to see work going offshore with dentists buying more on price than value.

“Today, you cannot assume that the client who is sending you all these cases will continue to do so forever,” says Adar. “Situations change and you have to change with them. You have to cultivate the relationships that you have with your clients, not take them for granted.”

Bring Value to the Relationship

So what can laboratories do to build a value-based business? Adar believes it requires changing the traditional mindset of the laboratory business to one that focuses on “how can I make my client’s life better or the patient’s life better” rather than simply developing new pricing strategies to respond to a competitive business environment.

Becoming an educator and mentor to clients on new materials, new technologies, and practice-management development strategies are all critical keys to helping clients grow their businesses and meet patient demands. “Most laboratories offer manufacturer-sponsored education that focuses strictly on clinical topics,” says Murphy. “But surveys indicate that the number one and two problems dentists have are dealing with dental insurance and how to hire and retain staff as well as other practice-management issues.” He advises laboratories to hire and partner with practice management and business development consultants, such as Mercer Advisors (www.merceradvisors.com), Jameson Management (www.jamesonmanagement.com), or the Levin Group (www.levingroup.com) to help clients deal with the business side of dentistry. “We need to help dentists create the same value for fine dentistry in the minds of patients as those patients have for good education.”

Helping dentists to communicate the value of restorative procedures and build their fee-for-service practices with their patients is a priority for Mike Dominguez, CDT, and owner of Seattle, Washington’s Kymata Dental Arts. He opened his high-end laboratory in 2009 at the height of the recession and has been able to overcome the economic challenges facing his clients and their patients, including the most recent treatment reimbursement reduction by Washington Dental Service’s Delta Dental. “We have been very proactive with our clients, offering flexibility in product choices, helping educate our clients on how to talk to patients about new material choices as well as providing our clients with services that will help increase treatment acceptance from a financially stressed patient base,” Dominguez explains.

He visits the practice to educate the client on the latest new material offerings and what benefits these new materials bring to the practice as well as to the patient. Converting clients and their patients to pressed or CAD/CAM designed and milled all-ceramic restorations also is more profitable for his business and has been key to the 50% income growth Kymata experienced in 2010. To offset the skyrocketing price of gold and bring price stability to his metal-based products, Dominguez transitioned to titanium, which he admits is more technique-sensitive to stack but is appealing to clients because there are no price surprises at billing. “By using titanium, we don’t have to give our clients an invoice with two charges, one for labor and the other for the cost of the alloy,” says Dominguez. “They and their patients know exactly how much that crown will cost.” Even though he CAD designs the titanium copings in-house and outsources the milling, the labor charged to the restoration is equal to that of a traditional porcelain-fused-to-metal (PFM) crown.

Taking advantage of new technology and helping clients navigate and understand the benefits of technology-driven restorative options is one of the biggest roles laboratories can play when it comes to educating and mentoring their client base says Levin. “If laboratories could educate dentists on what technologies are efficient, which are effective, and what the return on investment is, laboratories can hit a home run in developing relationships with their clients.”

Thayer Dental Laboratory, based in Mechanicsburg, Pennsylvania, has done just that with their motto of “Your Partner in Mastering New Technologies®” and is reaping the benefits. Craig Yoder, CDT, Thayer’s laboratory manager, and his team hold Academy of General Dentistry (AGD) accredited seminars at the laboratory for their clients on new materials and techniques. Since 2009, they have witnessed a 40% increase in all-ceramic crown production, and in 2010 they achieved the highest sales in their 35 years of service to the dental profession. “We have always been an educator for our clients and a valuable resource,” says Yoder, who credits the education they are providing clients on the latest materials and technologies for the large percentage jump in all-ceramic production. For clients still prescribing gold-based restorations but who were getting pushback from patients on price, Thayer brought in controlled-cost alloys and lower-cost precious alloys to meet those clients’ needs.

To help their most valued clients push patients feeling financially pinched to commit to high-end esthetic treatment plans, Dominguez suggests offering a diagnostic wax-up for the case and not charging the client unless the patient accepts treatment, or charging the client and then removing the charge off the fee at case completion. Cassidy agrees that this is a most effective method to help dentists push treatment acceptance. “For patients to be able to see what the end result will be before treatment begins is a powerful selling tool.”

Helping clients bring value and service to their patients by breaking larger treatment plans down into affordable, phased segments is another way laboratories can build the client/laboratory relationship. It keeps the patient engaged in the practice and not looking elsewhere for less expensive treatment alternatives. Cassidy often uses phased treatment for patients who only “want to fix what’s broken” and not address underlying functional issues because of financial constraints. “My laboratory provides me with a diagnostic wax-up of the case addressing all the functional issues,” says Cassidy. “They then create a clear Memosil impression of the wax-up as my guide. I then correct the primary problem, which may be two anterior crowns, but use composite to fix the lower worn dentition, for example, and a posterior plane of occlusion issue. That way, the patient can return to complete the treatment plan one crown at a time if they wish.” And, if anything happens to the composite-treated teeth, Cassidy is more than happy to get the patient back into the practice, add more composite, and charge them a $65 fee.

To help market their clients’ services to consumers, Cassidy’s laboratory partner also publishes case presentations in local magazines showcasing their clients’ high-end esthetic results and identifying the treating dentist. “Patients call the laboratory in Athens and, based on the patient’s location, the laboratory recommends one of its clients,” says Cassidy. “I’ve been the beneficiary of some very good cases coming from these advertorials.”

These types of services create value in the relationship. Laboratories increase their ability to succeed and grow if they help their clients avoid and solve problems with case planning issues, turnaround times, as well as offer tiered or volume pricing structures that dentists are comfortable paying, Levin says. “One thing I know about dentists right now is that—just like the average consumer—they want more value for everything they spend.”

Conclusion

Dentistry, like the general economy, is continuing to make a slow comeback. The biggest question among those involved in the dental business is: When will the industry, often referred to as “recession-proof,” begin to return to 2006 spending levels where so much was being spent on elective services? Will consumers continue their new savings behavior and continue to defer treatment? Or will dental patients revert to pre-recessionary spending behavior and accept new proposed treatment? Based on research from the Levin Group Data Center, Levin believes that the dental industry has finally hit bottom and will now begin a slow five- to six-year recovery to attain 2006 levels.

“The bottom line is Americans want to be beautiful. As things settle down and the sting from the recession fades, they will start spending again on their appearance,” he says. But they, like those in the business of dentistry, will have had more than five years to develop a hardcore value-driven purchasing mentality that may never be forgotten.

References

1. US Department of Health & Human Services. Centers for Medicare and Medicaid Services web site. National Health Expenditures Aggregate Amounts and Average Annual Percent Change, by Type of Expenditure: Selected Calendar Years 1960-2009. https://www.cms.gov/nationalhealthexpendData/downloads/tables.pdf. Accessed August 8, 2011.

2. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2011. Chicago, IL: American Dental Association; May 2011:5.

3. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2009. Chicago, IL: American Dental Association; March 2009:12.

4. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2010. Chicago, IL: American Dental Association; April 2010:14.

5. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2011. Chicago, IL: American Dental Association; May 2011:14.

6. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2009. Chicago, IL: American Dental Association; March 2009:9.

7. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2010. Chicago, IL: American Dental Association; April 2010:11.

8. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2011. Chicago, IL: American Dental Association; May 2011:11.

9. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2009. Chicago, IL: American Dental Association; March 2009:10.

10. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2010. Chicago, IL: American Dental Association; April 2010:12.

11. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2011. Chicago, IL: American Dental Association; May 2011:12.

12. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2009. Chicago, IL: American Dental Association; March 2009:8.

13. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2010. Chicago, IL: American Dental Association; April 2010:10.

14. American Dental Association Survey Center. Survey of Economic Confidence: First Quarter of 2011. Chicago, IL: American Dental Association; May 2011:10.