Dentists’ Insurance Need Sebb and Flow

David H. Shantz

In the game of Life, players land a job, get married, have a baby, buy a house. Money in, money out—the game shows the ebb and flow of life.

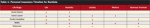

The need for insurance coverage also ebbs and flows throughout real life. Based on Great-West’s observations of dentists during more than 70 years of underwriting and administering the American Dental Association (ADA) Insurance Plans, we have developed a general timeline (Table 1) that identifies when the average dentist requires varying levels of personal insurance (ie, insurance that protects you personally—life insurance, disability insurance, health insurance, and professional liability insurance). Use the timeline to evaluate your own insurance needs, recognizing that these are general guidelines only and consult your financial advisor for specific recommendations.

During Dental School

If you are a dental student, you probably have amassed substantial educational debt ($100,000 or more is not uncommon). Purchasing insurance, specifically disability and life coverage, can help minimize the financial risk associated with this debt.

With life insurance, if you die before you have paid off your loans the insurance benefits can help provide the money to repay those debts so that they do not become a burden to your family. If you become disabled, a monthly disability insurance benefit can provide a source of income to help make your monthly loan payments.

In addition, your relative youth and good health will likely result in the lowest possible insurance costs. Some groups, like the American Student Dental Association, offer free or deeply discounted insurance to student members, which can be continued or converted upon graduation.

Launching a Career

Most states require that you hold professional liability (malpractice) insurance before you treat your first patient. The cost will depend on the type of policy, the limits of the liability coverage, the geographic location of the practice, and the types of procedures and treatments provided.

In addition, you should have adequate medical insurance to cover your healthcare expenses because just one uninsured illness or accident could be financially disastrous. To save money on premiums, consider a plan with a higher co-pay and deductible (the amount you agree to pay out-of-pocket each year before the insurance company pays), and one that offers a health savings account to pay healthcare costs with pretax dollars.

At this point, if you have not yet purchased life insurance, do it now. Many experts recommend life insurance coverage equal to 8 to 12 times your annual income. If you cannot currently afford to buy all the life insurance you ultimately need, buy as much as you can afford now, and purchase more later. Keep in mind that you must qualify medically for additional coverage in most cases. If you try to purchase more insurance after you have developed any health problems, it could cost significantly more—or be unavailable altogether.

Disability insurance is another must have as you launch your career. Data collected by Great-West from disability claims from ADA members covered by the ADA Income Protection Plan show that dentists have about a 1 in 3 chance of becoming disabled at some point during their years in clinical practice. Therefore, disability income insurance, which replaces your income if you cannot work as a result of a disability, is critical coverage from the first day of your career.

When shopping for disability income insurance, look for a policy that defines disability as the inability to practice your own occupation (ie, dentistry) rather than a policy that only pays benefits if you are unable to work in any occupation. You should purchase enough disability insurance to approximate 60% of your net income before taxes, which is roughly how much you take home after taxes to support yourself and your family. You can save money by selecting a longer waiting period (the time that must elapse from the date you first become disabled until benefits begin) or by forgoing options you might be able to add later.

Acquiring a Practice

At this important milestone, your insurance needs change again. For example, most practice financing firms require dentists to have enough life and disability insurance to guarantee that your loan can be repaid in the event of your death or disability. In addition, if you have a business partner, you may agree to purchase life insurance on each other to fund a buy-sell agreement.

As a business owner, you should also strongly consider purchasing business overhead insurance, which will reimburse you for certain monthly office expenses such as payroll and rent if you become disabled. Being able to keep up with those expenses can help your practice stay afloat while you recover or give you time to make plans to sell it.

Midlife Milestones

Throughout midlife, you will reach personal and career milestones that will signal the need to review and possibly change your insurance coverage. To guide your insurance review, ask yourself the following 3 questions: Have the people in my life changed? Has my practice changed? Has my income changed?

For example, as your practice expands and overhead expenses rise, make sure your professional liability and business overhead insurance remain adequate. A growing practice also means a growing income—and a corresponding need to increase disability income protection.

Marriage and children are special reasons to review insurance needs. With each change to your family, consider if you have adequate life insurance to preserve your family’s standard of living. Does your spouse have life insurance to sufficiently reflect his or her contribution to the family’s finances? Do your beneficiary designations reflect the current family roster (eg, new spouse versus ex-spouse and all of your children)?

During these years, medical insurance should be periodically evaluated. Consider adding supplemental medical insurance, which can pay a guaranteed cash benefit under specific circumstances (eg, if you or a family member are hospitalized or diagnosed with a critical medical condition).

Retirement planning and saving for other goals, such as college expenses, are typical priorities for dentists during these years, and insurance can play an important role. For example, you may decide to exchange your term life insurance for a universal life policy. Universal life insurance offers insurance protection plus the ability to accumulate money on a tax-deferred basis to help pay college tuition, expand your practice, or supplement your future retirement income.

Nearing Retirement

As retirement approaches, your insurance needs change once again. When you sell or close your practice, you likely will cancel your professional liability and business overhead policies. When you stop practicing, you will not need disability income insurance (because you will not be earning an income as a dentist anymore). A word of caution: Before you reduce or cancel any policy, be very sure you no longer need that coverage, because it may be difficult, expensive, and/or impossible to replace it later, depending on your age or health.

With the children grown and debts paid, you also may be motivated to decrease your life insurance coverage or convert it to a paid-up policy. Or, you may opt to redirect your existing life insurance benefits to a favorite charity or a trust named in your estate. At this stage of life, as in every stage, let your goals and financial situation guide your decisions.

David H. Shantz is vice president of Group Special Accounts at Great-West Life & Annuity Insurance Company. Great-West underwrites and administers the American Dental Association (ADA) Insurance Plans and is the sole provider of ADA-sponsored life and disability insurance to ADA members. For a free copy of the ADA’s comprehensive Insurance for the Dentist handbook, call 888-463-4545 or go to www.insurance.ada.org.

| About the Author | ||

David H. Shantz David H. Shantz Vice President Group Special Accounts Great-West Life & Annuity Insurance Company Greenwood Village, Colorado | ||