You must be signed in to read the rest of this article.

Registration on AEGIS Dental Network is free. Sign up today!

Forgot your password? Click Here!

Reorganizing Your P&L Statement Can Improve Profits

Measurability with the proper level of magnification begets manageability

Randy Leininger, MBA

In one of my favorite practice management consulting parlor tricks, I explain to dentists that I can tell them in less than 30 seconds whether or not I can help their practice become more profitable if they just let me examine their profit and loss (P&L) statement. Many respond unimpressed that anyone could do that, but then I tell them that I want them to remove all of the data first so that I can see it with no numbers on it. At that point, I usually get a confused look followed by questions about how to remove the numbers. They can have their office manager remove them using the spreadsheet or they can simply remove them with a black marker or a pair of scissors.

When the dentist hands me the numerically edentulous P&L statement, I turn my attention directly to the expenses section. If it starts with "accounting expenses" and ends with "uncategorized expenses," and everything in between those two categories is in alphabetical order, then I can almost guarantee that there are additional dollars available to the practice's bottom line (ie, net income).

A magician is never supposed to reveal how a trick is performed, but I am not a magician. The secret behind this trick is based on the principle that "if you measure it, you can manage it." A single list of expenses in alphabetical order is being recorded, not measured; and therefore, it is not being managed.

Creating a Management P&L Statement

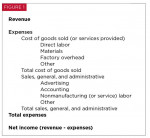

A quick internet search will enable you to see how publicly traded companies organize their P&L statements. In its simplest form, a management P&L statement looks something like what is depicted in Figure 1. The reason that large, publicly traded companies use this type of format for their P&L statements is because they manage all aspects of their businesses down to the penny, and thus, require a measurement tool capable of facilitating that level of management. For such companies, a 1% to 2% margin above or below their quarterly performance targets can translate into millions of dollars in positive or negative stock valuations. If we took this format and customized it to the needs of a dental practice, the P&L statement would look something like what is depicted in Figure 2. Some practice owners may look at this format and feel that it is too simple whereas others may look at it and feel that it is too complex. All of them could be correct. The major sections of a P&L statement should be further customized to meet the needs of each individual practice.

Revenue

For a practice that was 100% fee for service and didn't accept insurance or patient finance plans, the revenue section could be a single line called "collections," and that would be appropriate. Some practices will add a "refunds" or "adjustments" line as a negative number in the revenue section to provide greater detail. This makes sense for anything on the P&L statement that you want to track without having to "drill down" in your accounting software. You could list $100,000 in cash and -$20,000 in refunds, or you could simply show cash as being $80,000—it's up to you. Remember, the goal of the P&L statement is not to report the numbers, it is to manage them. Therefore, if the practice is focused on reducing refunds, it may be helpful to break those out on the P&L statement, so they aren't hidden. To manage it, we must measure it.

Expenses

The expenses section is divided into two main categories: dental operations and general and administrative. To understand what goes into each category, think of the dentistry that you provide as a physical product. When a manufacturing company makes a product, they need direct labor and materials to produce it. They might also need a building and specific equipment to make it. All of those costs are operational. Once they have produced the product, they need to get it to their customers and get paid. The expenses involved in advertising the product, sending invoices, and shipping the product to customers are all general and administrative costs.

The dental operations category should capture all of the costs of doing the physical dentistry, whereas general and administrative should capture all the costs of providing the dentistry. As you divide your expenses for your dentistry between operations and administration, try not to overthink it. If it touches the patient's mouth, it's probably operational. Everything else is general and administrative.

Accounts and Subaccounts

The secret to crafting a good P&L statement is to achieve the proper level of "magnification" so that you can see the numbers that are most critical to the optimization of the practice. This magnification happens via the creation of subaccounts. In a P&L statement's expenses section, each line that doesn't begin with "total" is considered an account. Indentation beneath another account means that the account is a subaccount. This hierarchy allows you to zoom in to whatever level of detail that you like. Subaccounts can be organized in a variety of ways, including the example in Figure 3. In this example, if you preferred to manage your laboratory fees by laboratory first and then by type (fixed or removable), you could nest your subaccounts to reflect that instead. An account can have as many subaccounts as your accounting software (or bookkeeper) will allow; however, be careful of "zooming in" too far with subaccounts. You only want to measure items to the degree that you are going to manage them. To set up the chart of accounts properly for your practice, it is recommended that you work with your bookkeeper.

What's the Difference?

If you are a practice owner with a an "alphabetical order-style" P&L statement that you look at once a year at tax time, then it is important for you to sit down with your bookkeeper and begin to get your accounting house in order. It could add 5% to 10% to your net income—possibly more. However, if you have the luxury of only looking at your P&L statement once a year, my promise of another $20,000 to $40,000 a year in income may not really motivate you. Although another $20,000 may not change your current standard of living, it could change your standard of living during retirement. If you're planning on practicing dentistry for another 10 to 20 years, investing $20,000 per year with even minimal compound interest will significantly move the needle for retirement. Furthermore, when it comes time to sell your practice, the more profitable that it is in your records, the higher the multiplier you can receive.

If that doesn't motivate you to overhaul your P&L statement, then do it to give more money to your team. You could use it to create a bonus program to alleviate some of the pressure that the postpandemic wage increases have caused at your practice, or you could use it to help you hire and retain great new team members. If you and your team members really have enough, then you can always donate the extra money that you make to charity. Whatever you do with the money, getting your P&L statement in order will make organizing your balance sheet and statement of cash flows easier and more meaningful. The P&L statement is only one of these three financial statements that you should be monitoring, but it is the best place to get started.

I promise you that organizing your P&L statement to make things more measurable and manageable will be worth your time and effort. It will help you to increase your net income without changing anything else that you do at your practice. You will continue to do the same things that you are doing now, but you will be able to do them more efficiently. If you want to lose weight, you need to measure how much you eat and how much you move. If you want to spend less on gas, you need to measure your gas mileage. Your P&L statement is a powerful measurement tool that will allow you to manage your practice into the business that you want to own.

About the Author

Randy Leininger, MBA, is the founder of Troutberry management consulting and the CEO of the Just Crowns dental laboratory in Boise, Idaho.